Many small business owners have to travel a few times a year or even as often as every week. Unfortunately, the cost of transport, lodgings, and meals adds up. However, you can cut down these costs by writing these fees off as business expenses by learning about IRS deductible travel expenses.

Learning how to write off travel expenses can save your business thousands of dollars each year. They also empower owners to network, visit clients, and attend valuable workshops. Finally, knowing which deductions are eligible for a write-off can save you a lot of stress at tax time. This travel expenses tax deduction guide overviews which expenses are deductible, how to deduct them, and how to calculate them.

The IRS allows tax deductions on certain travel expenses when the trip's main purpose directly relates to your business. Since the line between business and nonbusiness travel is hard to draw, you can take a few steps to ensure your trips' overhead costs qualify.

For a trip to qualify as business travel tax deductions, you must:

Taking these steps to ensure your travel qualifies for a tax deduction will ensure you get the correct deductions.

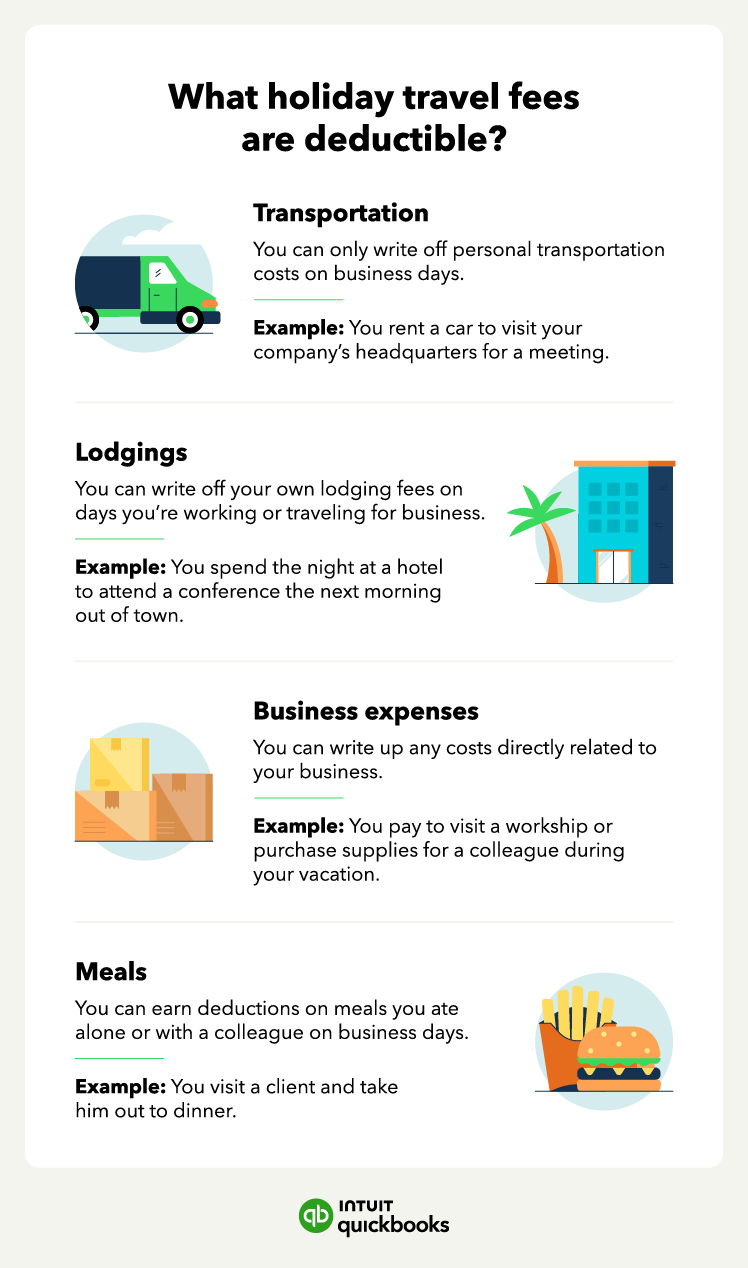

Understanding business tax deductions is easier with a list of example write-offs. While most expenses outside your tax home qualify for deductions, here are the most common travel expenses that are tax deductible:

However, there are some travel expenses you can’t deduct, such as family travel and lodging costs, entertainment, and unnecessary or unreasonable expenses.

For example, you may deduct your plane tickets from your home to the destination, a lunch meeting with a client, and a rented computer while traveling. However, you can’t deduct the hotel stay for your family members or if you take your client to a concert.

Even if you go on a trip for business purposes, incorrectly filing your tax deductions could stand in the way of a write-off. To ensure the IRS covers every expense, plan your write-offs before leaving and hold onto your receipts once you get home. The main steps to follow include:

Before you can bank on a write-off, you must ensure a trip is eligible for business deductions. The IRS uses rigid criteria to weigh business expenses, so make sure your write-offs meet all the standards.

The eligibility criteria for a business trip tax deduction include:

Additionally, you can write off lodging, taxis, car rentals, and 50% of your food costs on business days. You can also deduct laundry, dry cleaning, personal grooming, and other “ordinary and reasonable” expenses for the trip.

Likewise, only 50% of your food costs are deductible, along with your portion of the lodging. So, if you usually rent a single hotel room but need a double and another room for the family, you can only deduct the cost of a single room. If you make a layover in another city for personal reasons, you cannot deduct those related travel expenses.

Tip: The IRS counts travel days as business days, along with any weekends or holidays sandwiched between appointments. If you schedule your time right, you can squeeze in personal vacation time and only have to pay for lodging, meals, and other personal expenses on days that don’t qualify as business days.

For example: If you plan to leave on a Thursday and have a business appointment on Friday and Monday, you will have accumulated five business days and can write off all expenses for them.

Business owners who try to deduct unnecessary or unreasonable expenses from their taxes may run into trouble. While you can deduct the cost of taking a client to dinner, that doesn’t mean you should spring for a thousand-dollar bottle of wine. Avoiding extravagant fees makes the IRS more likely to accept your deduction.

Note : The IRS offers a temporary 100% deduction on business meals ordered from a restaurant between Dec 31, 2020, and Jan 1, 2023. In all other cases, the write-off is 50%.

Track all expenses by holding onto every receipt from your trip. While not every expense will earn a write-off, it’s worth checking in with a tax professional before throwing any away. Over time, small write-offs and unexpected deductions lead to huge savings.

The IRS doesn’t require that you keep receipts for payments less than $75, but you do need to keep a log of the time and date of the expenses. To streamline the process, you can use QuickBooks expense tracking software .

Once you narrow down the receipts eligible for a deduction, organize them into different categories. Group food, transport, and lodging fees into their own folder and write notes explaining when and how you made each expenditure. You'll be in good shape during tax season if you do this while the information is fresh.

Earning a travel deduction means keeping accurate records of your spending. On a business trip, you should tally up your fees on an expense sheet.

Use this free travel expenses write-off calculation sheet to find the estimated amount you can write off for travel expenses. Make a copy of the spreadsheet and input your expenses by category to use the total as a reference.

Please note this is an estimation tool and should not be taken as financial or tax advice. Always refer to IRS guidelines for the latest updates.

Once tax season rolls around, you need to make sure that you properly file your travel expenses. For self-employed travel expenses, you will list travel write-offs on Schedule C Form 1040. Businesses must claim travel expenses on Form 2106 and report them on Form 1040 or Form 1040-SR as an adjustment to their total income.

While there’s no annual travel deduction limit, the IRS scrutinizes higher write-offs. Be sure to calculate your business expenses with a tax attorney before submitting a large filing.

To calculate the estimated travel deductions, you can use one of the following formulas. When tallying write-offs, be careful about what you consider a business expense. While baggage fees, laundry costs, and admission to a workshop all count, you shouldn’t include personal expenses like souvenirs. Additionally, you can only write off entertainment costs when treating a client, vendor, or business acquaintance.

This formula applies to business trips that involve no personal days. The entire trip consists of travel and business purposes.

Travel deduction = Transportation + lodging + business expenses + (meals / 2)

This formula applies to business trips with vacation time sandwiched between business days. As long as you spend more time on business than leisure, you can include transport and lodging costs in your deductions.

Travel deduction = Transportation on business days + lodging + business expenses + (meals on business days / 2)

This formula applies to trips that are mostly for business with vacation days at the beginning or end or personal vacations with at least one business day. You cannot deduct any fees from personal days, so you will end up spending much more on lodgings and transport.

Travel deduction = Transportation on business days + lodging on business days + business expenses + (meals on business days / 2)

If your business requires you to travel, you could be missing deductions that can shrink your taxable income and grow your bottom line. While travel expenses must be business-related to be 100% deductible, taking a little vacation time during a trip isn’t unusual.

With that in mind, here are some ideas that you might be able to coordinate with or plan “in and around” your holiday travel to maximize your tax deductions.

While these ideas might begin as a tax write-off, they can grow into a relationship with clients, business partners, and vendors.

Some businesses keep working through the holiday season, so you may find some overlap between family and business. However, IRS auditors invest time and resources into ensuring these expenses relate to business and not a holiday trip.

Here are the main points to consider when deducting write-offs during holiday travel:

Remember to follow IRS guidelines. Passing vacation expenses off as a business write-off will trigger an IRS audit. The IRS may level a fine and revoke other business write-offs. So, to keep earning future tax deductions, stay within IRS guidelines and pay for your own vacation expenses.

Going on a business trip is a worthwhile opportunity to expand your business, meet potential investors, and boost professional development. Whatever the reason for your next business trip, learning how to write off travel expenses can help you save money to invest in other areas of your business.

Whether you're a solopreneur going on your first business trip or you have regular meetings across your state’s borders, keeping records of your expenses is crucial to claim tax deductions. An accounting software like QuickBooks Self-Employed can help you track your expenses on the go so you never lose a receipt.

With QuickBooks, get every tax deduction you deserve.If someone claims a deduction they don’t qualify for, the IRS penalizes them for these disallowed business expense deductions. This penalty occurs when business owners use write-offs to pay substantially less income tax than they should have.

In general, the IRS defines substantially less as the equivalent of a difference of 10% of what a business owner owes, or $5,000—depending on which is higher. Not only will the IRS audit you for disallowed deductions, but they’ll also charge a fine.

What is the penalty for a disallowed business expense?Business owners have to pay a penalty for disallowed expenses. They owe 20% of the difference between what they needed to pay and what they actually paid for their income tax. In other words, if you write off disallowed business expenses, you must pay 120% of your tax obligation.

How do I prove travel expenses for taxes?To prove travel expenses for taxes, you should keep a record of your expenses, such as receipts, vouchers, and invoices. As a general rule of thumb, don’t write off an expense unless you can prove it relates to work. Keep your records handy to discuss the expenses and accurately fill out tax forms with your CPA at the end of the year for a well-balanced tax return.

Recommended for you

What is a bridge loan? How does it work and is it right for your small business?

February 13, 2024

Income statement: Definition, preparation, and examples

January 19, 2024

Cost of goods sold: How to calculate and record COGS

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.